Stablecoin Depegging

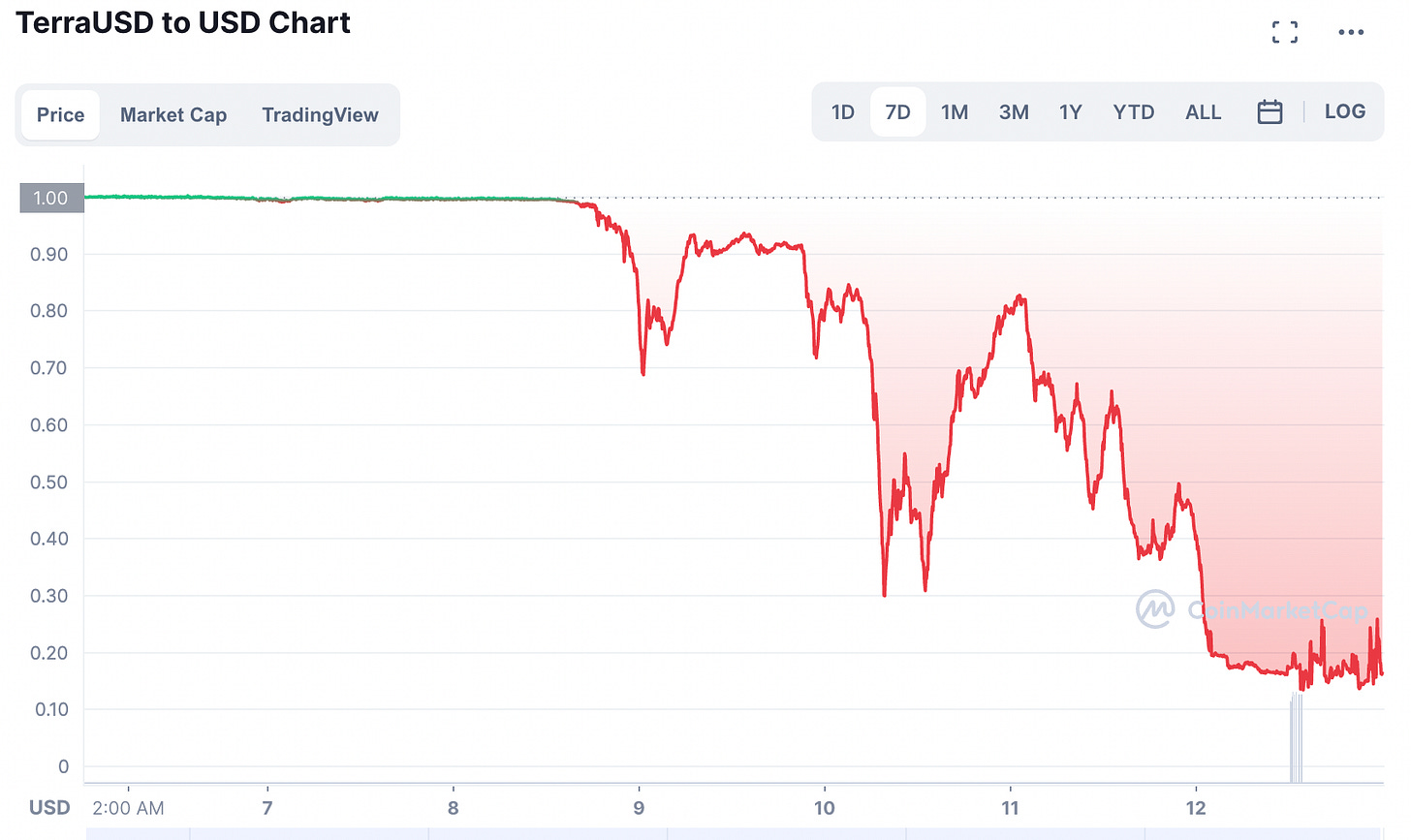

TerraUSD (UST) is an algorithmic stablecoin. It's meant to maintain a 1:1 fixed exchange rate (peg) with the U.S. Dollar. The theoretical price of UST should be $1. It's currently trading at $0.16. What happened?

Stablecoins like Tether and USD Coin peg themselves to the U.S. Dollar by holding dollar reserves or short-term U.S. securities (note, not all are transparent about their reserves).

Algorithmic stablecoins aren't backed by assets by rather a mint/burn mechanism – instead of swapping UST for $1, you can swap UST for another $1 worth of another token, Luna. When UST deviates from the peg, there's an arbitrage opportunity between UST/Luna (above $1, exchange Luna for UST, below $1, exchange UST for Luna).

In an inflationary and uncertain market, the demand for "stable" stablecoins rose – UST amassed an $18 billion market cap. Tether is the largest stablecoin, at $80 billion.

Of course, stablecoins have depegged from the dollar before – periods of intense buy/sell activity can create larger and larger deviations.

More than 75% of UST's market cap (about $14 billion) was deposited in a lending protocol called Anchor (also operated by the developers of UST). Anchor offered a service to invest in UST by burning Luna and achieving a 19.5% yield (or up to 100% yield through levered protocols like Degenbox). Too good to be true.

Last week (May 9th), UST depegged from UST – just below $0.99. Money started to move out of deposits like Anchor. The market cap of Luna and UST flipped – meaning Luna couldn't absorb the volatility. Turns out that the 19.5% yield was really payment for the lack of liquidity.

As the price started to fall, those who running a leveraged version of this strategy were liquidated, exacerbating the problem.

I wrote about stablecoin regulation in my 2022 Predictions, which are doing fairly well four months in (Twitter acquisition, NFT market, etc.).