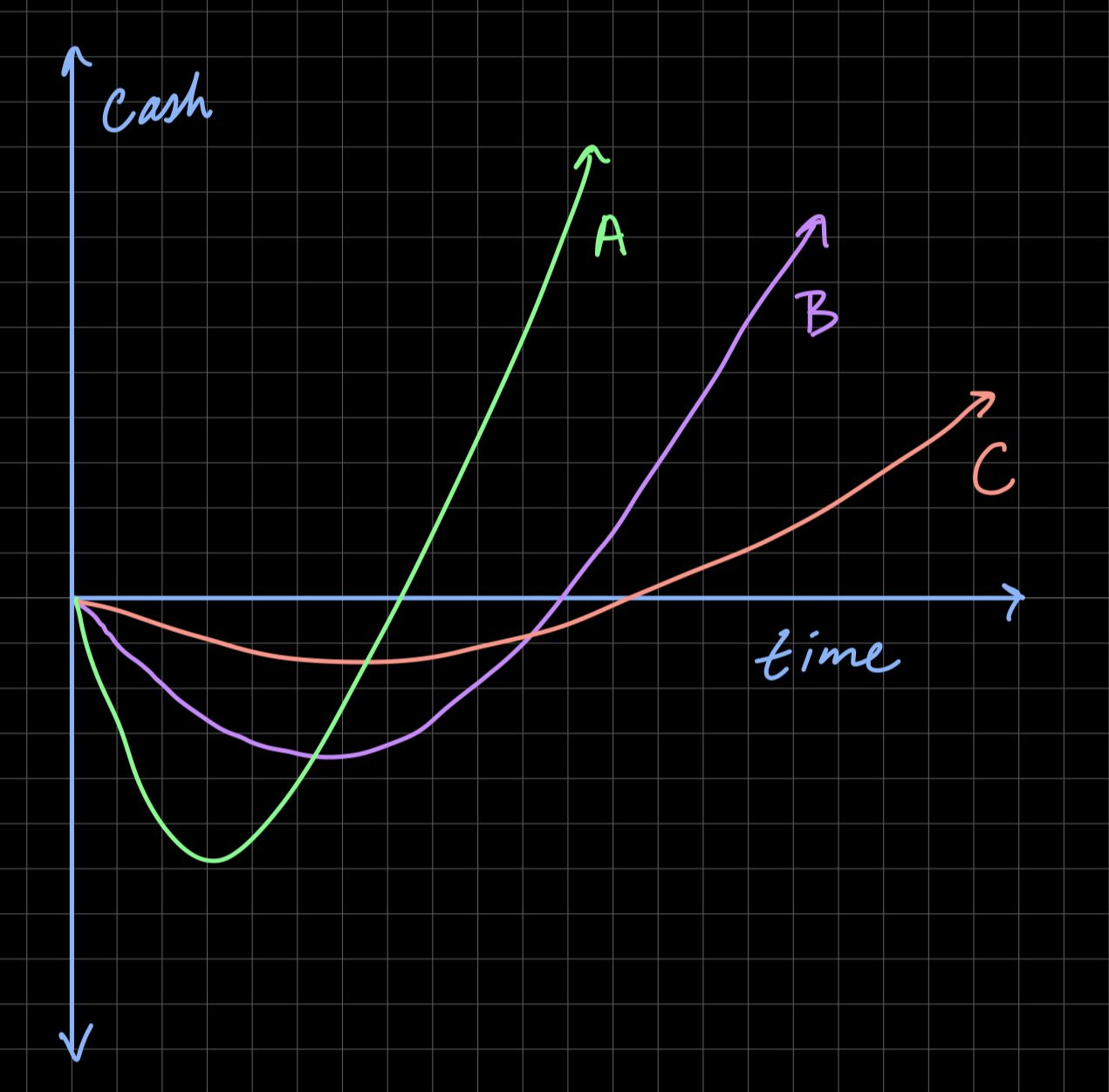

J-Curves

Why do SaaS companies raise so much money even when they aren't "profitable"? The answer is in the J-curve – a useful tool for understanding upfront investment across a variety of disciplines.

Imagine you're selling an enterprise software product. You need to hire sales people to sell it. However, they won't immediately be effective – they need 12 months to ramp up to hit their target quotas. In the meantime, you'll lose money, but over time the recurring revenue they bring in will more than pay for their salaries and commissions.

The interesting part is extrapolating. Software is essentially zero marginal cost so why not hire X sales people and bring in X times the revenue in 12 months? The higher the initial investment, the higher the eventual growth rate of the positive cash flow part of the equation. The exercise becomes one of scaling efficiently, cash flow and burn management, and optimal growth rates.

You can find J-curves in other places as well. In private equity and venture capital, funds normally deploy capital in the first few years of operation – net cash outflows. In later years, the early investments (hopefully) begin to pay off and the fund starts to return capital.

There's extreme risk in the early parts of the J-curve. Bad investments, bad products, bad management can all stop the music before the good part of the curve. But that's why these assets belong to their asset classes.