Direct Registration System (DRS)

2021 was all about ownership. Diving into a new trend in retail investing: Direct Registration.

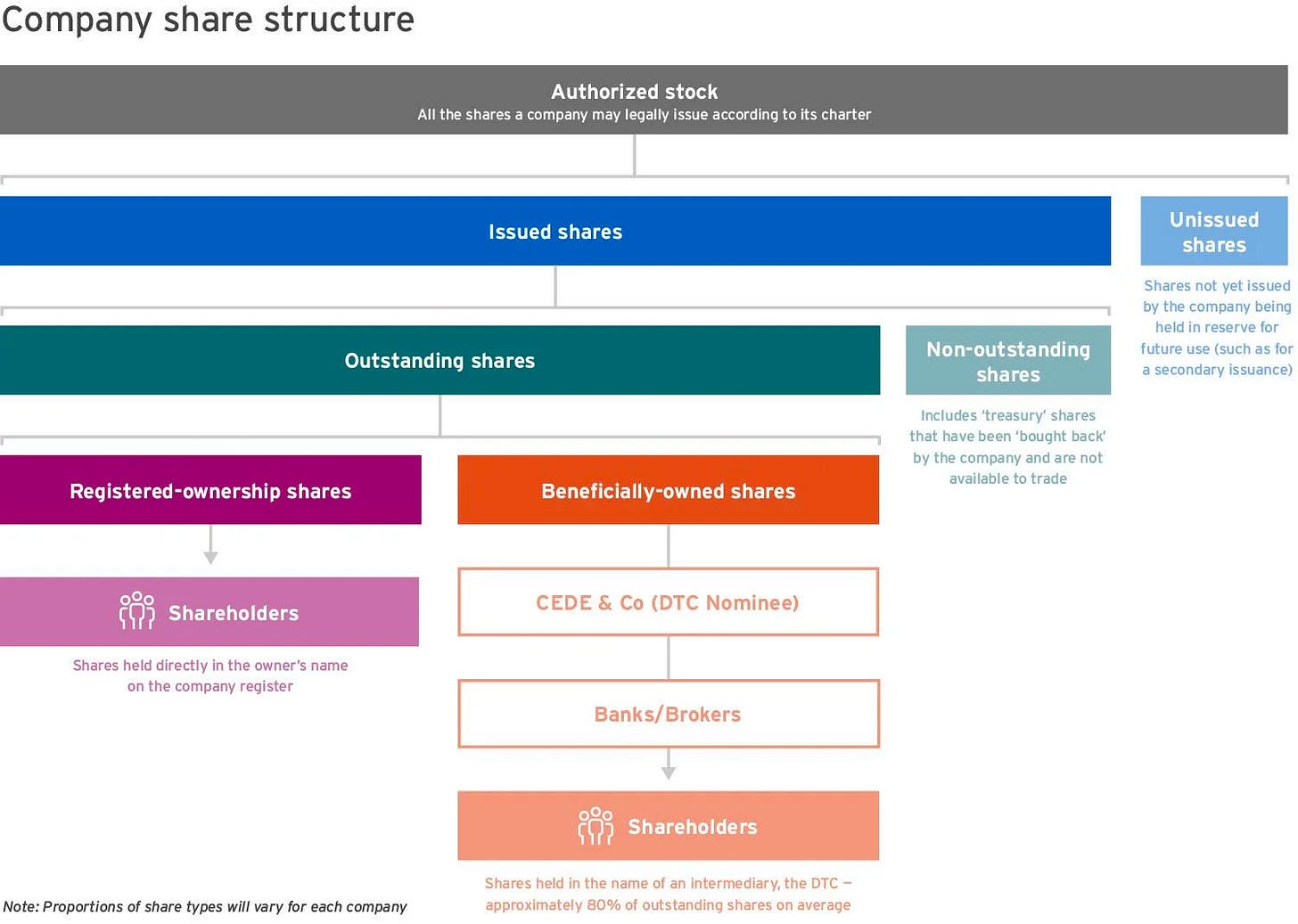

There are three ways to hold securities in the United States: a physical certificate, "street name" registration, and direct registration.

"Street name" registration means that the securities are held under a different name, usually the broker-dealer firm's name with you listed as the beneficial owner. You don't receive a certificate, but the broker-dealer shows that you own the securities on your account statement.

Brokerages are able to lend out your shares to short sellers. In many cases broker-dealer can also rehypothecate – borrowing against assets that have been posted as collateral by their clients. After the 2008 crash, rehypothecation was limited to 140% of the loan amount. If a broker-dealer goes bankrupt, your securities are only insured up to $500,000 under the Securities Investor Protection Corporation (SIPC).

Direct registration lets you hold securities in their your own name electronically. Proxy materials, corporate communications, and everything else goes directly to you.

When it comes time to sell your securities, DRS is a bit more complicated. Some issuers have programs in place to accommodate such requests, but many do not. Most likely, you'll have to move your security back to the broker-dealer to sell. Only broker-dealers can execute limit, market, or stop orders.

Why are redditors turning to DRS? The GameStop "apes" of Reddit are moving their shares from online broker-dealer to DRS in troves. It's their hopes that DRS is a way to "short squeeze" GameStop yet again. With DRS, broker-dealers can no longer lend out $GME shares that the Reddit "apes" buy. Other Redditors are wondering if they will get an NFT drop for $GME shareholders if their shares are tied up in a brokerage.

The DRS issuer for GameStop is a small Australian company called Computershares. It's pretty interesting, because not only does Computershares look like its from the 1990s, but it also charges fees for practically everything (transfer, per order, per share, direct deposit) in an age where we're so used to free trading (Robinhood, etc.).

Creating an account and transferring your shares is anything but easy. Brokerages don't want to let their shares go ($$ fees), and up until recently Computershare has never processed transfer requests for so many retail investors. If your shares are in a retirement account or IRA, it may be logistically impossible for you to direct register your shares or you may have to pay early distribution taxes.

The overarching theme of 2021: ownership. Consumers want more ownership of their assets. This theme is evident in the NFT and crypto craze. GameStop "apes" found that they really didn't own as much of their shares as they thought – online brokerages were able to lend out their shares and borrow against them.

The real question is whether or not consumers want the true cost of ownership. We've seen crypto wallets fall prey to easy scams with no chance for retrieving any lost funds. NFTs or tokens wiped out of wallets by clicking on a bad link or visiting a site that has an obvious JavaScript exploit (BadgerDAO).

GameStop "apes" and Computershare shows us that some retail investors are willing to pay fees and go through pain to own their shares. Is there more consumer surplus in DRS than free trades? My guess: probably not. Many companies have tried to give consumers more control over their securities like voting in shareholder meetings, but it traditionally hasn't worked. On the other hand, sometimes it seems that the pendulum has swung too far in the direction of institutions away from the retail investor.