2022 Predictions

How do I become a better decision maker? In a world of ever-increasing information, It's only becoming more difficult to filter through sources, check cognitive biases, and collect useful data from your hypothesis. Before I dive into my 2022 predictions, a set of frameworks and ideas about decision-making that have influenced me in the past year.

Two-way vs. one-way decisions: Some decisions are reversible. Others are not. Make irreversible decisions with high conviction, make reversible decisions even with lower conviction.

90% of everything is crap: Predicting what won't happen is significantly easier than predicting what will happen. Focus on what could go right.

Bias and noise in decision making: There are two dimensions of error in decision-making: bias creates errors in the same direction, noise is variability in judgements that should be identical. Separating and triaging each type of error is essential to testing hypotheses and making corrections.

So as I make a guess as to what will happen in 2022, I'll try to be thinking through these ideas. The goal is not Nostradamean accuracy, but an opportunity for reflection next year to hone my decision-making skills.

High Conviction

Remote development hits mainstream.

There's alignment between company (lower cost, more secure) and end-user (lower friction). The majority of FAANG already develops like this. Microsoft is actively pushing users towards this with the open sourcing of vscode-server and GitHub's native Codespace functionality. Finally, the Browser as an OS trend creates tailwinds for new developers to onboard like this. Not to mention the continued work-from-home trend.

Writing:

I have no stake in the ground as to who wins this trend. The best distribution usually wins, and Microsoft has it (as usual). Replit is creating an interesting alternative, but has the wrong kinds of users and the wrong focus. Enterprise SaaS plays like Gitpod and Coder can't compete with Microsoft by selling Microsoft's open source product (while MSFT gives it away for free).

Ownership reigns. The securitization of everything.

Markets will be created for virtually everything. The majority of these markets won't be liquid and will die, but a few will survive. The most successful will be the securitization of real assets, while the most abstract will fail to keep steam over time. Right now many of these securities are built on cryptocurrency networks, but I don't think that will matter for most use cases. In fact, building off the blockchain will simplify most of these securities.

Writing:

As a lower conviction bet, I predict there will be new regulation around this, especially pertaining to token as securities. As to whether or not this will be good policy, that's TBD. These markets do need to be regulated – best bid/offer, wash trading, KYC/AML, and flat-out scams. With the right regulation, we'll all be better off.

Databricks and Snowflake become direct competitors as the data analytics stack and data science stack consolidate

This is already happening to some degree as the data warehouse and lakehouse architectures collide (why do you need two separate queryable stores on top of S3?). There's already been existential talks of the death of the data scientist. Is it the end? Is it unbundling?

Writing:

Medium Conviction

SaaS economics become less attractive.

In the 2010s, SaaS companies competed against legacy perpetual license and on-prem companies. Now, SaaS companies increasingly compete against other SaaS companies. Margins will fall due to the increased cloud tax as hyperscalers move up the stack, and increasing customer acquisition costs. Net dollar retention (NDR) will trend lower for the majority of companies as vendor lock-in is traded for increased distribution (e.g. through open-source, open standards, or data sovereignty).

Writing:

Rebundling of the different stacks and developer personas.

Developers will be rebundled according to a common set of tools and responsibilities. The market desires this for a few reasons:

Hiring will be increasingly difficult for technical talent. Remote companies compete with every company friendly timezones. Fewer roles lower the hiring and training burden.

As technical ability becomes more stratified, it doesn't make sense for companies to pay the same for an engineer that builds a dashboard and an engineer who designs a distributed system.

I believe the market will eventually settle on three tiers. Here's how I see it playing out over time.

Data analysts / data scientists / database administrators (Dashboards / Visualization). Knows SQL and development-grade Python.

Data engineers / DevOps engineers / Site reliability engineers (Plumbing / Automation). Knows scripting languages and automation. May know a general purpose programming language like Go or C# to write automation tooling. Mostly focused on observability and monitoring. Plumbing cloud services.

Frontend developer / Backend developer / Full-stack developer (Core Systems). Designing product architecture. Building scalable systems choosing or building development frameworks.

Writing:

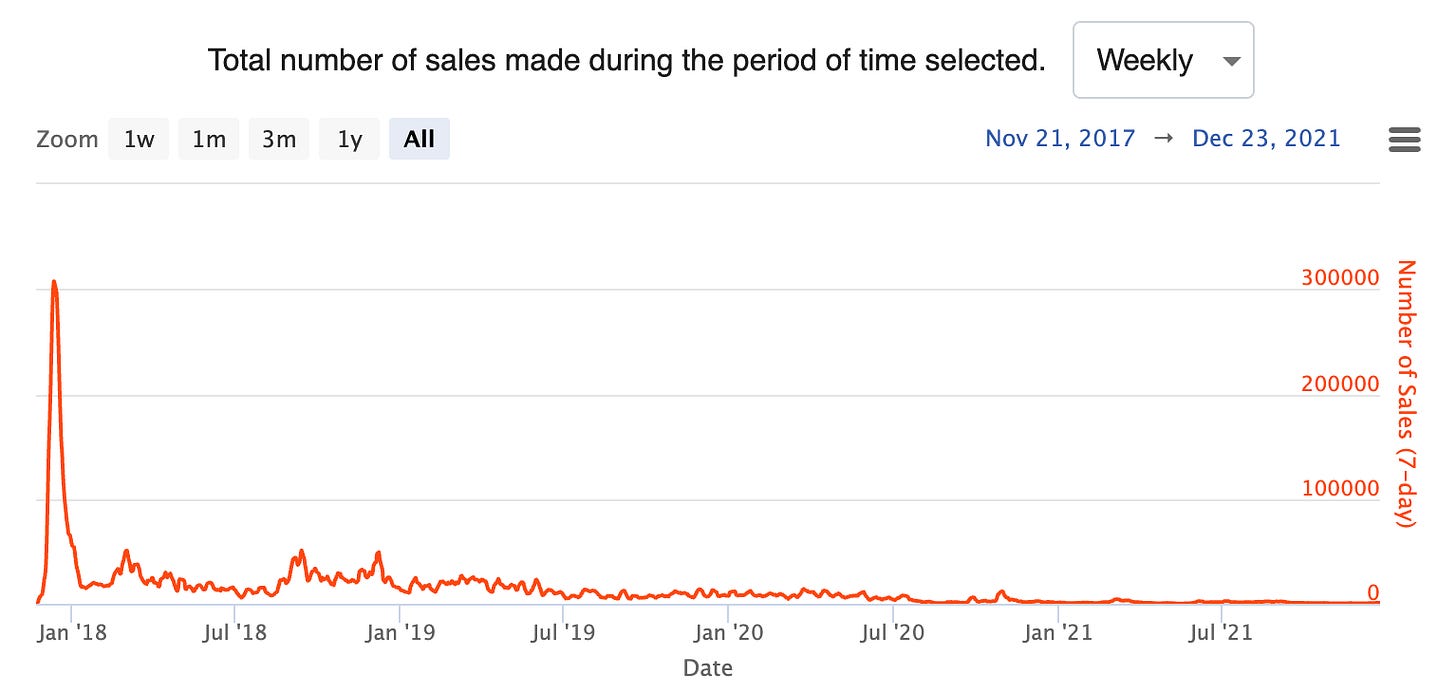

NFT craze ends. Many are left as bag holders of assets with no buyers.

Even though one of my higher conviction bets is ownership, many of these markets will turn out to be illiquid. Many communities are driven by token economics that benefit early adopters and are less favorable to long-term holders of assets.

Cloud hyperscalers deliver the best developer UX

I don't think we give AWS enough credit for its developer experience. Sure – the dashboard look like they're from 2010. CloudFormation takes too long. There's 200+ services with overlapping or tangled architectures. But they fundamentally delivered on what customers want: reliable and scalable building blocks that work well together.

AWS and other hyperscalers aren't shying away from building vertical SaaS solutions. Many have predicted the rise of "industry clouds" like the AWS / Goldman Sachs partnership. At the end of the day, many of the experimental DevEx solutions are built on the intersection of two or three hyperscaler services (Vercel/Netlify: CDN + EC2).

Writing

Large tech companies will find it difficult to make employees return to the office. No mandatory in-office date set.

There's a prisoners dilemma here: if all the tech giants cooperate and decide to bring employees back to the office, employees will have no choice. If even one defects, that company will have their pick of the best remote workers. Startups founded during the pandemic will continue to be remote-only, although some may regret it.

I still think there's an advantage to having a small co-located team. Many companies will find that remote isn't much cheaper (or actually, is more expensive) than having an office. Hiring remotely is often hiring globally, and it will pose significant challenges to fully remote companies. More candidates to screen, fewer network effects (references, word-of-mouth, etc.), and magnified benefits that accrue to the best companies and punish the rest (adverse selection).

Low Conviction

Interest rates will increase, inflation increases.

Macroeconomic events are always hard to predict and useless to plan for as a startup – but the wannabe-macroeconomist in me likes to think about this for fun. This may lead to a contraction in SaaS multiples except for the best names (this is already happening). BNPL takes an enormous haircut.

Web 2.0 holdouts get acquired by big names

Again, hard to predict any of these, but I wouldn't be surprised if we see Pinterest, Twitter, or Etsy get acquired. As the Apple App Tracking Transparency (ATT) rules change the game, different parts of the e-commerce stack will be forced to combine. Payments + Shopping (Shopify / Pinterest). Enterprise B2B + Communications (Salesforce / Twitter). Meanwhile, e-commerce solutions will be unbundled as there are clear winners and losers. Etsy has stayed alive by acquiring smaller brands like Depop and e-commerce acceleration during the pandemic. But going forward, I could see a take private deal to unwind some of Etsy's brand-of-brands strategy.

Cryptocurrency regulation is coming. Specifically for stable coins.

SEC Chair Gary Gensler has been quite open that cryptocurrency regulation is under the SEC's mandate and that tokens are securities. Gensler gets a lot of hate in the crypto community, but he's actually very knowledgable about the topic (he taught a popular class on crypto at MIT while he was a professor there).

I think Gensler is right to want regulation. Without smart regulation, it's difficult for legitimate companies to compete with outright scams. Predatory tactics and unfulfilled promises of profit often crowd out those building businesses. Every scam or misleading project erodes trust (which is what I believe is behind most engineers' distrust of crypto).

Regulation for Roblox and investigation into its aggressive micro-transaction tactics aimed at children under 12.

The commentary around Instagram and its effect on children overblown. The real practices we should be looking at are in Roblox. Depending on the game, users are prompted with the opportunity to buy virtual items every few minutes. 25% of users are under age 9. 50% of users are under age 12. Asking children under 12 to pay with micro-transactions seems predatory to me.

The worst part is that it works. In 2021, Roblox reported $13.49 in bookings per daily active user per quarter. While the majority of bookings most likely come from "whales", there's all sorts of anecdotal evidence of small children running up large bills on these games.

I'm not sure the public is aware of exactly how aggressive Roblox is marketing to children, but when it inevitably is brought to light, I think there will be a regulatory response.